Slowdown in demand for mineral products in Q3

Third quarter of 2021 sees fall-off in demand due to product shortages and rising costs

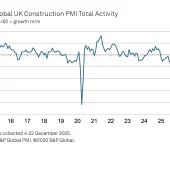

DEMAND for mineral products essential in construction slowed in the third quarter (Q3) of 2021 after strong sales during the spring and summer.

The latest quarterly survey from the Mineral Products Association (MPA) shows that volumes of primary aggregates and ready-mixed concrete were 6.7% lower in Q3 2021 compared with the previous quarter, with asphalt down 4.3% and mortar down 3.7%.

The MPA survey is a direct indicator of construction activity because mineral products represent the biggest volume of materials used in construction and MPA members supply up to 90% of those materials. Including the other materials supplied by MPA members, such as minerals for manufacturing, agriculture, and leisure, the sector produces some 400 million tonnes per year.

Feedback from the producers of aggregates, asphalt, ready-mixed concrete, and mortar in Great Britain suggests the slowdown is the result of several factors – the pent-up demand for materials from the lockdowns in 2020 is starting to subside, pinch points elsewhere in the supply chain are impeding progress on construction projects, and mineral products companies are wrestling with limited haulage capacity and rising costs of energy, raw materials, labour, and carbon.

Haulage is a particular issue for bagged products, with driver shortages impacting on deliveries to merchants who continue to experience extended delivery times.

Energy costs are affecting all mineral products companies, but especially cement manufacturers whose production costs are impacted by rising wholesale electricity prices and the significant increase in the carbon price in the UK Emission Trading Scheme. Even before the recent spike in gas prices, cement producers in the UK faced both a higher carbon price and amongst the highest industrial energy prices in Europe because of government policy decisions. Costs will be further exacerbated by forthcoming tax increases and the removal of the red diesel rebate.

Despite the recent challenges, the supply of mineral products has remained brisk, with sales volumes in Q3 2021 higher than in the same quarter in 2020. On a 12-month basis, sales registered double-digit growth at the end of Q3 2021 across all markets monitored: 15.7% for aggregates, 15.8% for asphalt, 11.5% for ready-mixed concrete, and 20.7% for mortar.

But the pace of recovery has been mixed across different products. Aggregates and asphalt sales have already surpassed volumes recorded in 2019, by 3.6% and 4.1% respectively. Demand for these materials was comparatively less impacted by the first COVID-19 lockdown last year, and sales were quickly propped up by an acceleration in demand from infrastructure projects, including roads and HS2. Mortar producers have also been busy in the past six months and the underlying demand from house building remains robust.

In contrast, the recovery in ready-mixed concrete has been slow, mainly because of the weak rebound in commercial development. The renewed fall in sales over the summer means that on a 12-month basis, ready-mixed concrete volumes are 7% below volumes recorded in 2019. London is particularly exposed to the commercial construction sector and ready-mixed concrete volumes there remain some 15% below 2019 levels.

The MPA anticipates that demand for most mineral products will remain relatively robust through 2022-23, assuming work accelerates on major infrastructure projects as planned. This is despite the ongoing shortages, delays, and cost increases that are expected to linger in the wider construction supply chain over the next 12–18 months. A lack of HGV drivers and limited haulage capacity will continue to affect mineral products supply.

Aurelie Delannoy, the MPA’s director of economic affairs, said: ‘There is a clear downside risk if the current inflationary pressures in the wider economy were to intensify and last longer than is currently factored in, as this could lead to weaker than expected economic and construction growth next year.

‘Furthermore, we were disappointed by the lack of an update on the delayed Integrated Rail Plan in the Chancellor’s recent Budget, which is due to set out how lines such as HS2 and Northern Powerhouse Rail will link up. Given government’s poor record on infrastructure and all-too-frequent policy U-turns, this kind of unnecessary uncertainty and delay reinforces and validates our concerns about the delivery of the infrastructure pipeline.

‘The challenges ahead will also be compounded by the planned increases in corporation tax, national insurance, and the removal of the red diesel exemptions. These are significant tax rises, on top of rising costs, which will be hitting businesses that are still in pandemic-related recovery mode and where business confidence remains fragile.’

Nigel Jackson, chief executive of the MPA, said: ‘Whilst it is good that we have a reasonably solid outlook for demand, spiralling costs mean the industry will continue to feel the pain, albeit mixed with some relief as the economy recovers.

‘Our energy-intensive cement and lime producers will be hardest hit as any earlier gains in 2021 are likely to be cancelled out in the latter part of the year. We need government to not just listen, but to act in support of those businesses genuinely struggling over the winter and reshape the operating environment for the longer term. We also need planned investment in road, rail, and green energy infrastructure to kick-in as scheduled without delay.’