New study reveals geological facility’s value to UK economy

Report highlights the scale of the National Geological Repository’s impact on major infrastructure projects

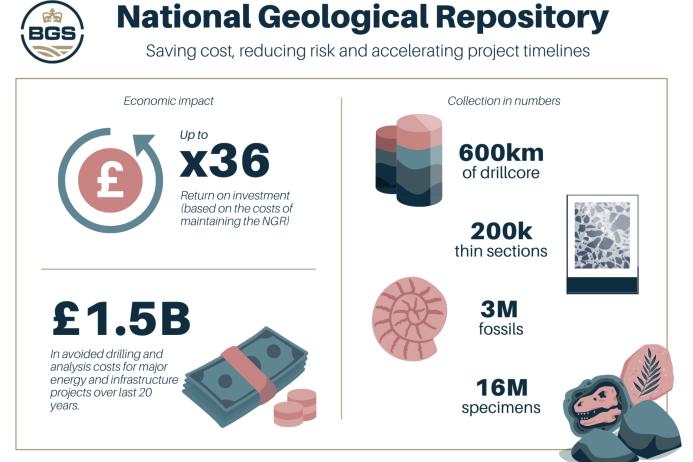

FOR the first time, an economic valuation report has brought into focus the scale of the National Geological Repository’s impact on major infrastructure projects. The National Geological Repository (NGR) is the UK’s most comprehensive collection of geological materials, consisting of more than 16 million specimens and assembled over 200 years. The collection acts as both an evidence base of previous scientific endeavours and a resource for new and future research.

The economic analysis shows that the NGR saves major energy and infrastructure projects significant costs through access and re-use of pre-drilled rock core:

£1.5 billion in avoided drilling and analysis costs for major energy and infrastructure projects over the last 20 years

Up to 36 times return on investment based on costs of maintaining the facility

Time-savings of around three years per infrastructure project through access to legacy core samples.

These returns are underpinned by the high costs of drilling new boreholes. It can cost more to drill an onshore borehole than run the NGR for a year, and this can rise by a factor of 20 for offshore drilling.

Located at the British Geological Survey’s headquarters in Keyworth, the NGR is home to the UK’s largest core storage and examination facility. Of particular value to industry and infrastructure projects are over 600km of pre-drilled core from around the UK, which provide considerable cost and time-saving benefits.

‘The BGS’ core facility (the National Geological Repository) is invaluable in enabling researchers to use legacy geological materials and data for new purposes in the transition to low-carbon energy,’ said Gary Hampson, Professor of sedimentary geology at Imperial College London.

Nick Terrell, industry co-chair with the Subsurface Task Force, said: ‘These cores were acquired at significant expense (often multiple hundreds of thousands of pounds per core) from offshore wells, specifically targeting areas of fundamental uncertainty in subsurface geology.

'Their preservation offers substantial economic and environmental value, as the cost of re-sampling or drilling new cores is prohibitively high. Moreover, the carbon footprint associated with new drilling can be significantly reduced by utilizing these existing core samples for further research and decision-making, aligning with sustainability and Net Zero ambitions.’

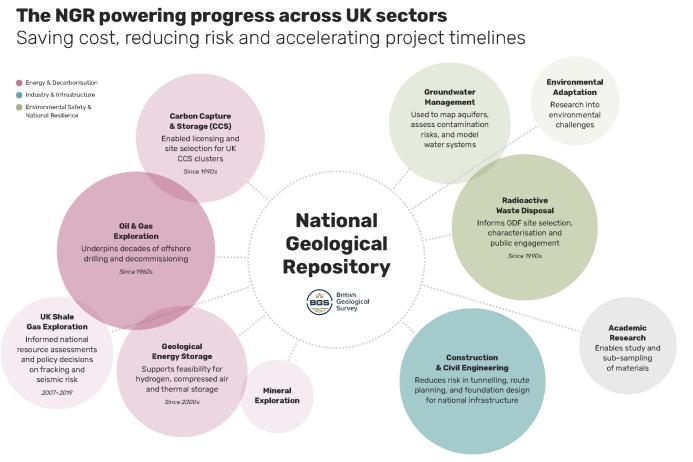

The facility is trusted by government, regulators, and industry to enable faster, better-informed decisions and is poised to enable UK clean energy infrastructure projects, including geothermal and carbon capture and storage.

As well as quantifying the impact of the NGR, the report also highlights a series of constraints that could limit the facility’s ability to deliver increased public value in future.

Expansion will be required to accommodate further core acquisitions. This is vital as many present-day drilling operations are occurring in areas with potential for net-zero technologies or mineral prospectivity, meaning the opportunity to re-use the core is high.

Further potential lies in digitizing the collection, as only a fraction of the physical holdings has been digitized to date, limiting the facility’s ability to deliver comprehensive remote access.

BGS is exploring investment opportunities to secure and enhance the NGR’s long-term future and national value. A copy of the NGR economic valuation report can be downloaded here.