MPA sales data conflict with official statistics

Association says construction market demand for mineral products improved in second quarter

THE Mineral Products Association (MPA) says sales of mineral products in the second quarter of 2016 were better than expected, in contrast with official statistics that show a reduction in construction activity since the beginning of the year.

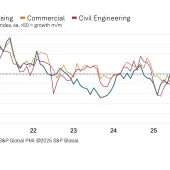

According to the Office for National Statistics’ first estimate for second-quarter growth, construction activity fell by 0.4% between April and June following a 0.3% decline in the first quarter, meaning the sector is technically in recession.

However, the MPA says that following broadly flat markets in the first quarter, its own quarterly survey figures, which are based on actual sales volumes of materials, show that aggregates, ready-mixed concrete and asphalt improved in the second quarter of 2016.

Compared with the first quarter, aggregates sales volumes increased by 1.5%, ready-mixed concrete sales were up 3.3%, and asphalt sales increased by 11.5%, while mortar remained broadly flat (up 0.2%) for the second consecutive quarter.

According to the MPA, annual sales volumes were also generally positive in the 12 months to the end of June 2016, with aggregates and ready-mixed concrete sales volumes up by 3–4% compared with the previous 12-month period, and mortar sales up 2% over the period.

Asphalt, which is suffering from the fact that workloads are materializing at a slower pace than had been suggested by Highways England’s spending plans, fell by 1% over the 12-month period in spite of the second-quarter improvement.

With the overall positive trend in these markets indicating an improvement in general construction activity, the MPA says it would have anticipated the official ONS data on construction output for the second quarter of 2016 to be positive.

Nevertheless, looking forward, and given the current economic and political uncertainty that affects the UK economy, the Association says it expects ready-mixed concrete sales to remain relatively flat over the next 18 months, rather than seeing the 3–4% growth per annum previously anticipated, due to slower housing activity and commercial construction.

Aggregates and asphalt are expected to see some declines, reflecting continued constraints on local authority road and transport investment, and workload from Highways England being delivered more slowly than previously expected.

In the longer term, however, the current pipeline of infrastructure work is positive for the industry, although the MPA says confirmation of the Government’s commitment to these projects is urgently needed to reinforce business confidence and encourage continuing investment.

Aurelie Delannoy, chief economist at the MPA, said: ‘Demand for aggregates and ready-mixed concrete grew in the second quarter and still has momentum. These materials are ubiquitous in construction, so we are very surprised that the ONS construction figures for the quarter were negative.

‘We don’t think that construction declined in the second quarter in spite of some negative commentaries about the sector, although over the year growth will remain muted. Output was strong in the second quarter of 2016 and everything needs to be done to sustain that positive momentum.

‘Whilst it is difficult at present to understand the full implications of the Brexit vote for construction activity, longer-term needs for increased housing supply and greater infrastructure investment remain and will need to be delivered.

‘Clear and continued government support in these areas, and measures to encourage private investment, will be necessary to help counter any potential adverse economic effects of the Brexit vote. This is needed to ensure an adequate supply of essential materials to the UK economy and to support growth.’