Concrete market plumbs new depths as business confidence slips

New industry figures from MPA reveal concrete volumes hit 62-year low in second quarter of 2025

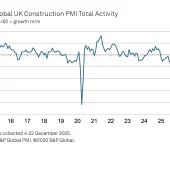

THE latest quarterly survey from the Mineral Products Association (MPA) shows that concrete volumes hit a 62-year low in the second quarter of 2025, fuelling fears of plummeting business confidence, stalling investment, and further driving down construction demand.

The data from MPA, based on actual sales volumes across Great Britain in the last quarter, also shows asphalt volumes over the last four quarters are the lowest in a decade. Aggregates and mortar sales also fell during the second quarter of 2025.

Ready-mixed concrete volumes dropped by 11.5% to just 2.7 million cubic metres in Q2 2025. Over the last four quarters (Q3 2024 to Q2 2025), total sales were 11.9 million cubic metres. The last time Britain's annual concrete volume was this low was in 1963.

Volumes across all major mineral products other than mortar are now at historically low levels, tracking below last year’s already weak volumes. The MPA is calling for urgent Government action to reignite business confidence, to encourage investment and to release stalled construction projects.

Reductions in sales of concrete will have had a knock-on impact on cement sales, which are not covered by this data but are reported separately. The most recent set of cement data, for 2023, showed weak sales but, more significantly, near record-low domestic production with an unprecedented proportion of imports, at 32% of the UK market. This is largely driven by high electricity prices, high labour costs, and a burdensome regulatory environment, says the MPA.

According to Aurelie Delannoy, director of economic affairs at the MPA, the Association had previously projected modest growth from a low base across these products in 2025, but this now appears unlikely. A worsening macroeconomic outlook, rising costs and additional taxes, plus mounting speculation over further tax rises in the autumn, are all contributing to a lack of investment, further weakening demand.

Confidence across the mineral products sector was already low but has evaporated in response to these pressures. The MPA says producers point to a chronic lack of new large and small-scale infrastructure projects, hampered by slow, delayed or deferred investment decisions, cost pressures and sluggish regulatory processes.The HS2 ‘reset’ looks set to have a negative impact on demand this year, while highways delivery continues to be plagued by uncertainty. July’s cancellation of the A12 Chelmsford to A120 widening and the A47 Wansford to Sutton schemes followed five other project cancellations in last year’s Budget to further damage confidence in infrastructure delivery.

In housing, MPA members continue to report weak activity, particularly in London and other major cities. While lower interest rates have eased mortgage costs, persistent affordability pressures, high inflation, and growing job insecurity continue to weigh on buyer confidence. Mortar sales, closely tied to early-stage housebuilding, fell by 2.7% in Q2 2025, ending four consecutive quarters of growth. Delays at the Building Safety Regulator with the new Gateway 2 approval process are delaying high-rise housing developments.

Aurelie Delannoy commented: ‘This quarter’s data offers a stark reminder that market conditions remain incredibly challenging for the mineral products sector. A fourth consecutive year of declining sales is now a serious risk, including to jobs.

‘What we are seeing is not just the challenge of a specific industry market; it is a broader signal of a UK construction sector and national economy stuck in first gear, hampered by weak confidence, patchy project delivery and a chronic lack of tangible demand. Despite the Government’s positive long-term announcements, businesses are still waiting for any concrete signs that the UK is ready to invest and to build again.’Chris Leese, executive chair of the MPA, added: ‘Many of our members are telling us that the current trading conditions are the most difficult they have ever experienced, including the 2007–08 financial crisis, while in concrete the data shows it’s the worst in a lifetime with no signs of recovery.‘The underlying problem is a total lack of business confidence leading to a lack of investment required to kickstart activity…Construction is a vital force for growth in the UK economy, and these sales figures are a clear indicator that action is required. We need action now to unlock stalled projects, back the businesses that will build them, and break out of this cycle of weak growth and high costs.’