Monitoring the Market

First published in the June 2022 issue of Quarry Management

A BDS market assessment of the heavy building materials industry in Great Britain

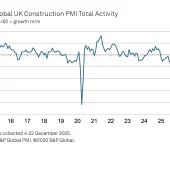

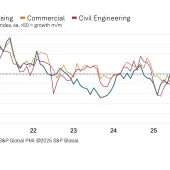

In Great Britain, the heavy building materials industry includes the mining, quarrying, and processing of raw materials to be used in construction projects. On a material level this includes output volumes for aggregates, asphalt and concrete, other downstream products, as well as the current and future activity of companies operating within these sectors. In 2020, the market experienced a difficult year with the COVID-19 pandemic negatively impacting all areas of the industry.

After the industry reopened in mid-2020, the market quickly began to rebound with two of the three key areas of the market back to pre-pandemic levels by early 2022. BDS, the leading independent consultancy in the heavy building materials and waste sectors, estimated the heavy building materials industry market to be c.390 million tonnes in 2021, with aggregates making up most of the market share, followed by concrete/concrete products and asphalt. Construction remained strong into the early months of 2022 with healthy order books, albeit with the sector coming under increasing pressure on several fronts, including rising energy prices, labour shortages, and pressures on the supply chain.

Aggregates market

The aggregates market is very closely connected to the building and construction industry. Around 90% of all aggregates produced within Great Britain are utilized within the industry and, when combined (ie primary, recycled, and secondary aggregates), the size of the aggregates market is estimated to be c.270 million tonnes. According to BDS, nearly 70% of the market is accounted for by the production of primary aggregates (crushed rock and sand and gravel), with the remainder divided between recycled and secondary aggregates.

Initially focusing on primary aggregates, the latest BDS estimated outputs for the industry show crushed rock contributes two-thirds of the market share, with the remainder split between land-won sand and gravel and a much smaller percentage of marine-won sand and gravel. As of December 2021, the primary aggregates market in Great Britain was estimated to be approaching 190 million tonnes. Comparing year-on-year figures, the figure for 2021 was nearly 25 million tonnes higher than for 2020, however 2020 was an unusual year, being impacted dramatically by the COVID-19 pandemic and the political and economic uncertainty relating to Brexit.

BDS have been monitoring aggregates industry activity for the last 30+ years and can confirm continual annual fluctuations in the aggregates market. Crushed rock is recognized as a substitute for sand and gravel, particularly when material or reserve shortages are apparent, in regions that have limited access to specific aggregates, or when transportation of materials is not readily available.

All aggregates are used across a broad spectrum of construction markets and growth within the industry is dependent upon the supply of aggregate meeting demand. Pressure for aggregates continues to increase annually across Great Britain and to meet demand there remains the need for adequate quantities of aggregates from all sources. Essential to this is the replenishment of sand and gravel and crushed rock to replace depleting aggregate reserves. The ‘Analysis of Aggregates Replenishment in Great Britain (2021)’ report, published by BDS in April 2022, suggests that in 2021 more sand and gravel was extracted than replaced. A total of c.31 million tonnes of new sand and gravel reserves were consented in 2021, compared with c.47 million tonnes of land-won sand and gravel extracted. In the same year, c.126 million tonnes of new crushed rock reserves were consented, compared with c.104 million tonnes of land-won crushed rock extracted.

The report also considers replenishment activity, which is of key concern to the industry. The replenishment rate relates to the replacement of extracted virgin materials with new reserves consented through the planning process. BDS have found that across Great Britain for the last eight years, for every 5 tonnes of sand and gravel extracted around 4 tonnes were replenished via new consents, and for crushed rock, for every 2 tonnes extracted just over 1 tonne of new reserves were consented.

BDS monitor planning activity across the minerals sector, identifying new applications and decisions on new reserves and extensions to the life of operating quarries to provide a full understanding of the industry to clients. This information is also available to subscribers through the BDS Planning Portal. In addition, BDS are due to publish their latest reserves report later this year. This will provide an estimate of both consented tonnages of reserves and the number of years’ life remaining for each identified primary aggregates site, as well as identifying planning developments for new reserves granted since 2020. According to the British Geological Survey, consented aggregate reserves at active sites for England and Wales, as of December 2019, were c.370 million tonnes for sand and gravel and 2.7 billion tonnes for crushed rock. BDS expect their 2022 reserves report to see these figures reduce overall, confirming that aggregate replenishment continued to fail to meet extraction volumes in 2021.

Recycled and secondary aggregates help to reduce demand on primary aggregates and, consequently, support the industry in becoming more sustainable. Recycled aggregates are predominantly produced from inert construction, demolition, and excavation (CDE) waste, whilst secondary aggregates are by-products of other extraction operations or industrial processes. BDS estimate c.80 million tonnes of recycled and secondary materials were used within the GB aggregates market in 2021.

Recycled aggregates are a sustainable and cheaper alternative to quarried material and are quicker to produce. They are popular within the industry with volumes of recycled aggregates increasing rapidly since 1996 alongside the introduction of the landfill tax and the implementation of the aggregates levy in 2002.

Secondary aggregates equate to c.3% of the total aggregates market and have become an established and important part of the heavy building materials supply chain. In the recently published ‘Secondary & Carbon Negative Aggregate Market in Great Britain’ report, BDS discuss the different raw materials that are used in the manufacture of secondary aggregates, the overall market share of the secondary aggregates market, and the environmental and sustainability benefits offered to the market if a proportion of the aggregates used comprise secondary aggregates.

To complete the understanding of the aggregates market, BDS also report on the movement of aggregates by rail and provide estimated aggregate outputs for all known land-won sand and gravel pits, marine wharves, and crushed rock quarries in Great Britain. In 2020, around 82 aggregates-receiving rail depots were believed to have been operational in Great Britain, fed by railheads at some 25 quarries. The latest BDS ‘Estimated Movements of Aggregates from Rail Depots in Great Britain’ report estimated that c.18.5 million tonnes of aggregates were moved via rail depots in 2020.

Concrete market

Ready-mixed concrete and precast concrete products are key downstream market sectors for the building and construction industry. BDS have estimated the output of ready-mixed concrete plants in Great Britain in 2021 to be c.24 million m3, an increase of 3 million m3 compared with 2020.

BDS also report on the concrete products market and produce annual output reports for concrete building block plants, concrete block paving plants, and concrete paving slab plants. In 2020 these three markets accounted for c.94 million m2 of products, with building block plants accounting for a 68% market share, block paving plants 17%, and paving slab plants 15%. BDS expect the market to have exceeded 100 million m2 in 2021.

Asphalt market

Of the leading asphalt producers in Great Britain, most are vertically integrated with plants located across most parts of the country providing a fixed outlet for their own aggregates production. This largely echoes the ready-mixed concrete market and, to a lesser degree, concrete products. Like other markets, the asphalt market experienced a rapid decline in 2020 due to the impacts of the COVID-19 pandemic. In 2020, BDS identified more than 250 operating asphalt plants and estimated the asphalt market to be c.25 million tonnes, with around 65% of asphalt plants producing less than 100,000 tonnes per annum. BDS estimate the asphalt market will have increased to c.28 million tonnes in 2021, with further detailed analysis of the market, divided by region and company, to be published in the second half of 2022.

In addition to reviewing the aggregates, asphalt, and concrete markets, BDS monitor and report on sector-focused planning applications for all counties across Great Britain, Northern Ireland, and the Republic of Ireland, and offer a bespoke consultancy service to support clients in meeting defined objectives. Consultancy research previously undertaken by BDS includes existing, new, and expanding sectors within the construction and waste industries, industry sector surveys, market size assessment and analysis, prospects for new investments, business growth and acquisition appraisals, product review and development, company analysis and market assessment, and other industrial market research. To find out more about BDS, published reports, planning activity, or how BDS may be able to support your ongoing work through consultancy support, visit: www.bdsmarketing.co.uk

- Subscribe to Quarry Management, the monthly journal for the mineral products industry, to read articles before they appear on Agg-Net.com