UK construction sector growth eases in October

Civil engineering remains best-performing category, followed by commercial work, but renewed decline in house building

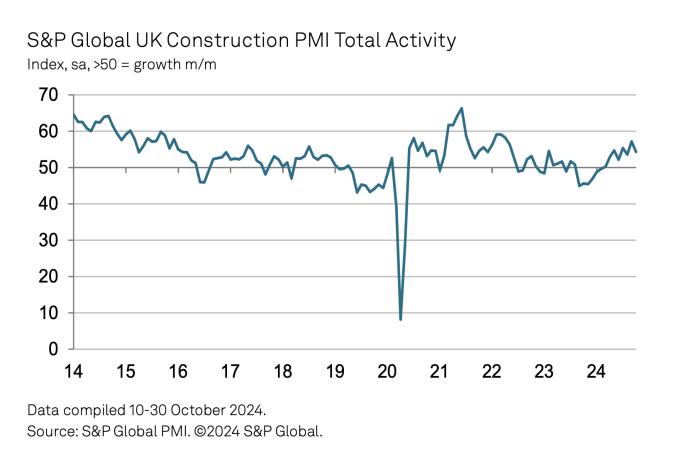

THE headline S&P Global UK Construction Purchasing Managers’ Index (PMI) registered 54.3 in October, down from 57.2 in September. However, the index was above the crucial 50.0 no-change threshold for the eighth month running. The latest reading was also well above the average seen in the first half of 2024 (51.4) and signalled a solid expansion of total industry activity.

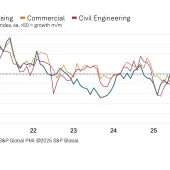

Civil engineering (56.2) was by far the best-performing category of construction output in October. Survey respondents again noted rising demand across a range of energy infrastructure projects, especially renewables. Commercial work (52.8) also expanded in October, but the increase was the weakest since the current period of growth began in April.

House building (49.4) was the only broad category of construction work to register an overall decline in output during October. This was the first decrease in residential activity since June, but the rate of contraction was only marginal. Some construction companies noted that elevated borrowing costs and uncertainty ahead of the Autumn Budget had constrained demand.

Total new work expanded at a solid pace in October. Mirroring the trend for output growth, the latest expansion was softer than the two-and-a-half year high seen in September. Political uncertainty and subdued household demand due to cost-of-living pressures were cited as factors limiting new order growth in October. That said, many construction companies noted strong sales pipelines and tender opportunities linked to generally improving domestic economic conditions.

Tim Moore, economics director at S&P Global Market Intelligence, said: ‘The construction sector signalled another month of solid output growth in October, despite being unable to match the highs seen in September. Business activity expansion was once again led by civil engineering work. Survey respondents widely commented on strong demand for renewable energy infrastructure projects.

‘Commercial construction activity also increased again, albeit at the slowest pace since the current phase of expansion began in April. Improving domestic economic conditions helped to boost demand, but some construction companies reported delayed spending decisions ahead of the Autumn Budget. October data meanwhile indicated a decline in overall residential construction activity for the first time since June. Government policy uncertainty, fragile consumer confidence, and elevated borrowing costs were all constraints on demand for house building projects.

‘Total new work expanded at a solid pace in October, adding to signs of a robust improvement in order book pipelines across the construction sector in the second half of 2024. However, business optimism remained relatively subdued in comparison with the highs in the first half of the year, with output growth expectations now the lowest since December 2023.’