Signs of stabilization in key construction mineral markets

MPA says cautious upward trend in third quarter suggests demand for construction materials now stabilizing

THE Mineral Products Association (MPA) has released its latest industry survey, revealing signs of stabilization in sales across Great Britain’s construction materials markets.

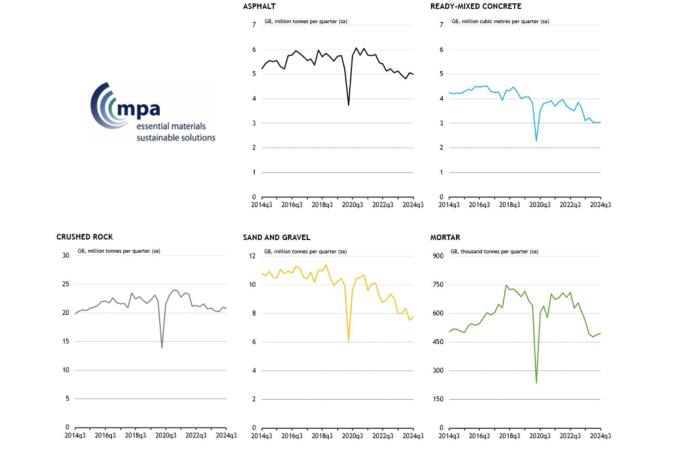

Covering five essential product areas – crushed rock, sand and gravel, asphalt, ready-mixed concrete, and mortar – the data for the third quarter of 2024 shows modest growth from a low base in some markets, following a prolonged downturn that began in mid-2022.

The survey highlights a 0.9% rise in ready-mixed concrete sales compared with the previous quarter, alongside gains of 3.7% in sand and gravel and 2.2% in mortar. Regionally, sales of ready-mixed concrete, essential to all types of new construction, grew in five of Great Britain’s 11 regions and devolved administrations, with the South East and West Midlands seeing the strongest gains.

This cautious upward trend suggests that demand is now stabilizing, though overall volumes across all markets monitored remain well below historical levels. Year-to-date sales volumes continue to lag behind 2023 levels, with ready-mixed concrete sales 14.1% lower, sand and gravel down 10.5%, and mortar experiencing a 20.1% drop.

The house-building sector, which drives the majority of mortar demand and around 30% of ready-mixed concrete, continues to grapple with low activity levels, despite improvements in mortgage approval rates and modest house price gains. High interest rates and affordability pressures are weighing on buyer demand, delaying the recovery in house building and subsequently the recovery in demand for essential construction materials.

While sales of asphalt and crushed rock have proven comparatively resilient this year, both materials have also declined. Budget constraints are impacting local authority road maintenance projects, and delays in major road schemes from National Highways are affecting overall demand.

However, there are pockets of growth, primarily centred on major infrastructure projects already under way, including HS2, Hinkley Point C, and groundworks starting at Sizewell C. Additionally, work on new gigafactories, such as the £4 billion Agratas plant in Somerset, continues to provide support to sales of aggregates and ready-mixed concrete.

‘The latest data suggest that construction mineral markets may have reached a low point, with early signs of recovery in some regions and markets. Yet, the demand environment remains challenging, with prospects hinging on a recovery in housing, progress on infrastructure delivery, and sufficient funding for local road maintenance,’ said Aurelie Delannoy, director of economic affairs at the MPA. ‘As we look toward 2025, we remain cautiously optimistic that an improving economic backdrop will support a gradual return to growth across the industry.’

In response to the Government’s Autumn Budget, which promised responsible, long-term plans for capital investment, the MPA notes that the construction mineral sector’s near-term outlook remains uncertain. Ms Delannoy added: ‘The increased tax burden complicates conditions for mineral products producers at a time when a steady supply of these materials is essential for economic growth and for advancing Britain’s decarbonization targets.’