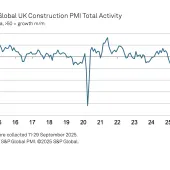

Infrastructure new orders continue to climb

Third-quarter figures for construction new orders boosted by major infrastructure projects

CONSTRUCTION new orders in the third quarter of 2015 were boosted by another strong quarter from the infrastructure sector, which contributed a value of £4.5 billion, an increase of 42% year on year.

Barbour ABI, the chosen providers of construction new orders estimates to the Office for National Statistics (ONS), values new orders for the third quarter at £16.1 billion, a figure that has been steadily rising for a number of years (see graph).

In a change from the recent dominance of the residential sector, four of the five biggest projects across construction in the third quarter came from infrastructure, including the £1 billion Thames Tideway tunnel project and the £600 million Race Bank offshore wind farm.

According to Barbour ABI, there is also evidence of a geographical spread across all the £100 million plus infrastructure projects in the third quarter, with schemes located in areas such as Northumberland, Cheshire and Lincolnshire.

This, say the research specialists, differs when compared with many other construction sectors, where the major projects are often London dominated.

Commenting on the figures, Michael Dall, lead economist at Barbour ABI, said: ‘The third quarter in construction saw an increase in new order values despite the wider slowdown in growth across the UK economy. In particular, the infrastructure sector experienced strong gains in the third quarter, with major projects such as the Thames Tideway tunnel reaching the contract stage.

‘These are the types of major projects that have been scarce in recent years so they provide a welcome fillip to the sector and, after further funding was confirmed in the Comprehensive Spending Review, future prospects for infrastructure have improved significantly.

‘In addition, the latest ONS output figures for October, which show growth of 0.2% compared with September, suggest a potentially stronger finish to the end of the year after the summer slowdown.

‘Overall, the levels of appetite for investment across construction remain strong at the contract stage. The problems lie more on the supply side at present, with skills shortages, in particular, a major challenge in moving projects from the conceptual to the delivery phase.’