February turnaround in UK construction order books

Renewed improvement in order books helped stabilize UK construction activity last month

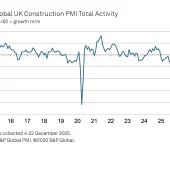

FEBRUARY PMI data pointed to improved demand conditions across the UK construction sector. Although only marginal, the rate of new business growth was the fastest since May 2023. A turnaround in construction order books contributed to a near-stabilization of overall output levels in the latest survey period.

Business optimism improved for the third time in the past four months and was the highest since January 2022, with construction companies often citing hopes of a sustained upturn in customer demand as well as more favourable economic and financial conditions over the course of 2024.

At 49.7 in February, up from 48.8 in January, the headline S&P Global UK Construction Purchasing Managers’ Index (PMI) registered its highest level since August 2023 and was only fractionally below the neutral 50.0 threshold.

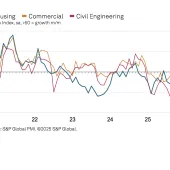

All three main categories of construction activity saw a near-stabilization of business activity in February. House building saw the biggest turnaround since January, with the respective index at 49.8, up from 44.2 and the highest level since November 2022.

Survey respondents suggested that improving market conditions had gradually contributed to a stabilization of residential construction work. In contrast, the commercial segment saw a more subdued performance than in January, with construction companies typically citing hesitancy among clients and constrained budget setting.

Total new work increased marginally in February, ending a six-month period of decline. This appeared to reflect a turnaround in tender opportunities and greater client confidence, especially in the house-building segment.

More than half of the survey panel (51%) anticipate a rise in business activity over the year ahead, while only 6% forecast a reduction. This pointed to the strongest degree of business optimism for just over two years in February. Construction companies mostly noted new project starts and positive signals for customer demand, partly linked to expected interest rate cuts.

Tim Moore, economics director at S&P Global Market Intelligence, who compile the survey, said: ‘A stabilization in house building meant that UK construction output was virtually unchanged in February. This was the best performance for the construction sector since August 2023 and the forward-looking survey indicators provide encouragement that business conditions could improve in the coming months.

‘Total new orders expanded for the first time since July 2023, which construction companies attributed to rising client confidence and signs of a turnaround in the residential building segment. Meanwhile, the degree of optimism regarding year ahead business activity prospects was the strongest since the start of 2022, in part due to looser financial conditions and expected interest rate cuts.’