Demand for construction products remains strong

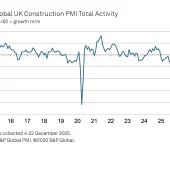

Construction activity buoyant, but strong headwinds coming, warns Construction Products Association

IN its latest quarterly forecast, the Construction Products Association (CPA) sees a dramatic slowing in growth, with uncertainty ahead as global issues start to affect the UK market.

In previous years, the predicted 2.8% growth in construction output anticipated by the CPA team would be cause for celebration. However, while a robust figure, this is a sharp revision down from the 4.3% growth forecast just three months ago.

Demand remains strong across the industry in the second quarter, and the current project pipeline suggests that this will support activity levels until at least the third quarter of 2022. The downward revision to the growth forecast stems from concern around a host of price pressures arising from both local and global issues.

Prior to the conflict in Ukraine, UK construction was already facing labour and product availability issues and the impact of reverse charge VAT and IR35. Rising energy costs were driving near-record price increases in construction products and the continued conflict is exacerbating this issue.

The impact of these pressures, and of more general rising costs, on demand will vary considerably by sector. Across the board, the picture is one of positive market conditions in the short term, with anticipation of tougher times ahead.

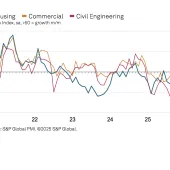

Private housing, the largest construction sector, remains strong, with house builders reporting resilient demand. Longer term, there will be questions over consumer confidence, but output in this sector is forecast to rise by 1% in both 2022 and 2023, which contrasts with the 3% per year growth forecast three months ago.

The fastest growth is expected in the industrial sector, in which output is forecast to rise by 9.8% in 2022 and 9.3% in 2023, due to a strong pipeline of warehouse projects, resulting from a long-term shift towards online shopping.

Infrastructure, traditionally less affected by immediate economic conditions, remains positive. Large projects such as HS2, Thames Tideway, and Hinkley Point C, combined with the five-year spending plans in regulated sectors such as rail, road, and power generation, point to a forecasted growth of 8.8% in 2022 and 4.6% in 2023.

On the supply side, the main immediate impact of the war in Ukraine for construction products will be the knock-on from rising energy prices and commodity shortages. Soaring energy costs will have to be passed on and lead to sharp rises in the cost of energy-intensive products such as bricks and cement.

CPA economics director Noble Francis said: ‘The major challenge is creeping uncertainty. The immediate picture is one of resilient demand and healthy pipelines. Longer term, the current inflationary pressures, if sustained, will have an increasingly depressing impact, while the continuation, or potential escalation, of conflict in Europe presents an existential risk.’