CECE releases Annual Economic Report 2017

European construction equipment market performed well in global context in 2016 with slight rise forecast for 2017

THE European construction equipment sector saw sound growth of 10% in 2016, with building construction equipment experiencing better demand than the civil engineering equipment sub-sector.

Overall, the market is at its highest level in five years, but still considerably below the pre-crisis record levels. These are the main findings of the CECE (Committee for European Construction Equipment) Annual Economic Report 2017, published this week.

As in 2015, the European market outperformed most regions of the world in 2016, and ranked third in growth numbers, behind only China and India.

‘The double-digit sales growth in 2016 sure was positive news for our industry in Europe, but we still see big disparities across the continent,’ explained Sebastian Popp, economic expert at CECE.

Volume-wise, the strongest sales increases were recorded in France, Germany and Italy. ‘The German market, in particular, and Northern and Western Europe, in general, are close to their historical record levels,’ said Mr Popp.

‘On the other hand, recovery in Southern Europe and Central and Eastern European countries still falls short of expectations, although a positive note was the revival of the Russian market after years of extreme deterioration.’

Sales of earthmoving equipment in Europe grew by 12% in 2016, while building construction equipment (tower cranes and concrete machinery) recorded an even higher growth of 21%.

‘It is encouraging to see that all construction machinery sub-sectors benefited from the upturn,’ commented Mr Popp. ‘This corresponds to the situation of our customer industry, which sees growth in both residential and non-residential construction as well as civil engineering.’

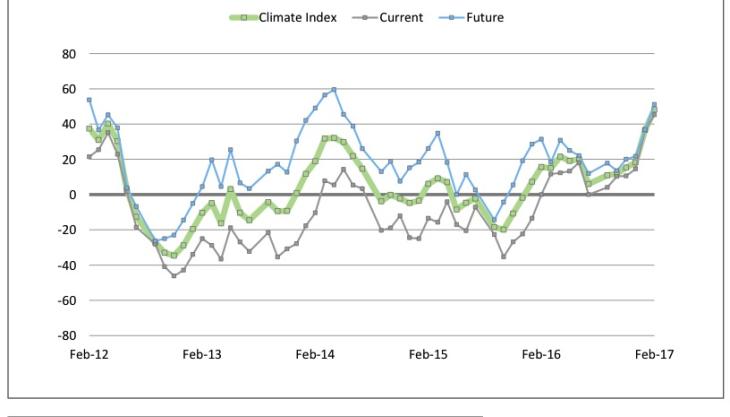

The CECE Business Barometer index had hit a temporary low following the Brexit vote in the summer of 2016, but has been on a growth path since then, resulting in the highest index value in almost six years in February 2017.

Interestingly, the manufacturers surveyed in 2017 saw almost all regions of the world in a positive light.

Fuelled by infrastructure investments pushed forward by the new government, the US market is expected to see an upturn, whilst China and India are anticipated to continue the upward trend seen last year. Likewise, a majority of European manufacturers expect the Middle Eastern markets to recover in 2017. Latin America, however, is not yet anticipated to bounce back from the low level seen in 2016.

For the European markets, the manufacturers surveyed in the CECE Barometer expect a generally positive scenario, except for the Turkish market. Hopes are particularly concentrated on Scandinavia, France, and Germany.

Optimism was equally strong across the sub-sectors, with approximately two thirds of earthmoving, road and concrete equipment manufacturers expecting an improvement in the business situation.

Only component suppliers do not trust the upswing in a similar way – amid a positive average assessment, 63% of them expect unchanged business in the near future.

Against the backdrop of a modestly growing European construction sector, generally positive industry sentiments and different stages of market recovery across countries, stable sales of construction equipment with a slight upward tendency appears to be the most realistic scenario for Europe in 2017.

Also, European manufacturers should be able to benefit from a world market that is expected to return to growth after three consecutive years of decline.

Meanwhile, CECE has appointed Riccardo Viaggi as its new secretary general. He succeeds Sigrid de Vries, who left the association in January.

Mr Viaggi, who will take up his new position in early May 2017, is an experienced EU governmental affairs professional who served eight years as secretary general of the European Builders Confederation (EBC).

CECE’s president, Bernd Holz, said: ‘Riccardo has strong management experience and solid knowledge of both our industry and the Brussels political environment. I am looking forward to working with him.’